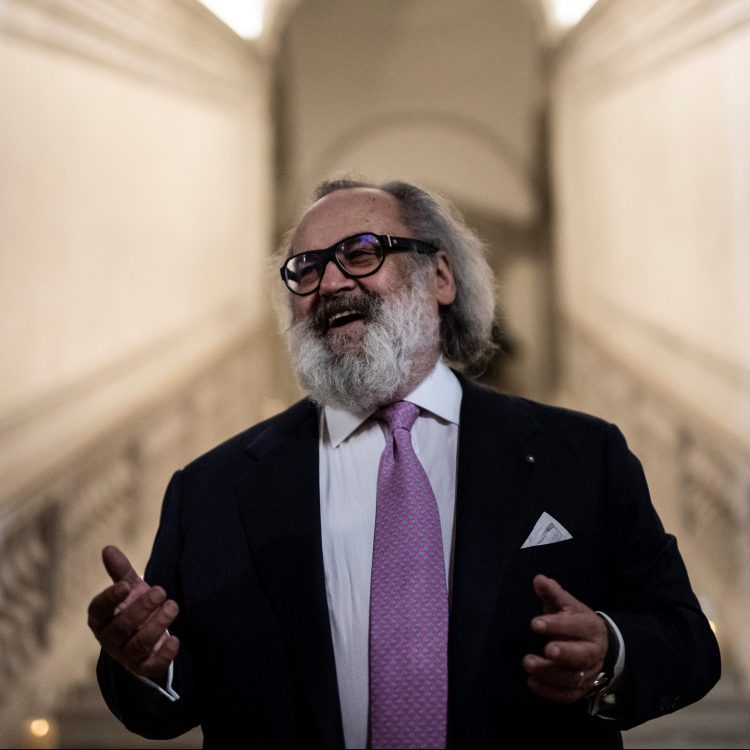

Sometimes Moses Rashid actually wears some of his 300 pairs of sneakers. But only if he can then still sell them for a profit. Take, for example, that pair of Jordan 1 Trophy Room — one of just 12,000 pairs made, which sounds a lot but isn’t for today’s sneaker production runs. He paid $2000 for those, wore them for a while — “lightly,” he says — and then sold them for $2400. By the way, the shoes were already second-hand — or “pre-loved” as the fashion world prefers to call it — when he bought them.

“I know, I know,” laughs Moses. “If you’re really deep into the sneaker world, as I am, this kind of thing is just my everyday norm. But if you’re on the outside I get that you might think ‘I just don’t understand how someone can spend even $500 on new sneakers’. To these people it must all seem completely alien. But once you’re in it it’s like the world of watches, or art or fast cars — it has a community attached to it that’s quite complex and incredibly fascinating but hard for people to get their heads around.”

Moses definitely has his head around it, as do his acolytes. Three years ago he founded The Edit LDN, a London-based sneaker trading platform. Last year it sold some 20,000 pairs of sneakers and generated $12 million in revenue. He’s just raised $5 million in seed funding — with NBA star P.J. Tucker and the New York Giant’s Xavier McKinney among his investors — and fully expects to be worth $100 million within three years, in no small part through a big push into the US market this year. He’s already signed a two year marketing partnership deal with the Chicago Bulls, and launched sponsorship of NBA tunnel walks.

“An interest in sneakers is almost in the blood in the US, seeing as it’s the birthplace of the trend for wearing them casually — [as a Briton] it always strikes me that you’ll see fairly ordinary, middle-aged men and women there wearing really nice Air Jordans. Or look at all the NBA guys court-side, wearing sneakers with their suits,” Rashid notes. “But while there are lots and lots of small, one man sneaker stores in the US, the global platforms that do operate there aren’t looking at the premium market and I think that’s why we’re being received well there.”

And Rashid really does mean premium. The Edit LDN’s average trading price is around $425. And, as he says — entirely straight-faced, as if this was utterly sane — some pairs go for $18,000. That is, for the price of a new Subaru Impreza. Or maybe a Nissan Versa.

Why so? Because while there are plenty of other sneaker platforms — the likes of GOAT and StockX — The Edit LDN specializes in strictly limited-edition sneakers. Or, as Rashid puts it, “the kind of sneakers that are sold out immediately after they’re released. The ones you can only get on the secondary market.” As it dawned on Rashid a few years ago (as he was handing over $800 for a pair at a sneaker festival, only to be told the seller didn’t even have a bag for him to put them in) sneakers have become a luxury item, but have lacked the luxury service to go with.

So that’s what his start-up is aimed to supply: it’s the middle man for high-rolling re-sellers who want to connect with sneaker-obsessed buyers, providing, Rashid says, not just marketing, authentication, pristine packaging and speedy delivery but, what’s more important, a curated selection of those shoes that are hyped to the sky but, it seems, impossible to get. Key to that are the connections Rashid has built with those super-sellers — the “ballers” as he calls them — who can get hold of them. He says that out of every 5000 sellers you’ll find fewer than 50 super-sellers. For some of these, The Edit LDN has even managed to carve out concessions in swanky landmark stores the likes of London’s Harrods.

“These sellers have ways of getting hold of these sneakers before they they come to us and sometimes before they come onto the market,” Rashid explains. “They might have certain [insider] relationships. They may use bots on sites, or win sneakers through raffles. They might be friends of the brands. They may even have just bought the sneakers from someone else with the community. By the time a pair of sneakers gets to us they may have passed through two or three pairs of hands. We had six pairs of Louis Vuitton Air Force 1s three months before they were released, for example, and that’s something we can sell to high net worth clients. It’s all not that dissimilar to the art market.”

Indeed, if that kind of back-room wheeler-dealering makes sneakers sound like an asset class for canny investors, that’s precisely what Rashid says sneakers at this level have become: the market is such that a limited-edition pair of sneakers will typically appreciate, and well at that. If he hadn’t worn them, Rashid says he could have sold those Jordan 1 Trophy Rooms a few months after he bought them at a $1200 profit. But this is a market, he adds, that’s fun to play — his customers typically buy upwards of five pairs per month — and which, unlike most other asset classes, has a low barrier to entry.

Everything Worth Buying From Nordstrom’s Insane Spring Sale

Take up to 60% off apparel, shoes, home goods and more from top brands“Different sections of the community are into different things. I’m more into the designer end of the sneaker market, but others have a huge amount of love for, say, the collaborations that Nike does,” says Rashid. “But, you know, sneakers have hit the runway and ever since Supreme did a collaboration with Louis Vuitton back in 2017 [or as Nike has more recently with Tiffany], the lines have become more and more blurred. As a high-end product sneakers get the same attention as, say, rare watches, or handbags. And some people find the obsessive interest in those alien too.”

Indeed, The Edit LDN has already diversified into watches and handbags — does that mean that Rashid is hedging his bets? Might, in a few years, what Alan Greenspan called “irrational exuberance” see us adding sneakers to the likes of Japanese real estate in the 1980s, dotcom shares in the 90s or cryptocurrency today? Aren’t sneakers just another bubble?

Unsurprisingly, Rashid doesn’t think so. He concedes there’s a greater diversity in footwear trends now — men flip back and forth between sneakers and their brogues or workboots. And, sure, he says, some people are jaded by all the sneaker razzmatazz. “But there’s still a huge raft of people that have yet to get into the market, who are standing at the periphery now wondering how to get into it,” he insists. “Interestingly, we’re seeing the rise of the female sneakerhead, which just wasn’t a thing before. Some months now 60% of our sales are to women who are really getting into the culture, against the stereotype that this is all for slightly nerdy men.”

What’s more, Rashid suggests that it’s a market that’s still building its head of steam, which is why every major luxury design house — the Pradas and the Guccis — is now necessarily moving into the sneaker space, in order to stay culturally relevant. Then you can throw in the fact that, thanks to pandemic lockdowns, remote working, to athleisure and health and fitness, we’re more comfort-minded about our footwear than ever.

“So will the bubble burst? Short answer: no,” he says. “What’s beautiful about sneakers is that, actually, it’s inclusive and there’s something for everyone. You know how if you drive a certain kind of sports-car drivers of similar cars will give you a nod of recognition as you pass each other? The same thing happens with sneakers. ‘Hey buddy, I love your sneakers’. Go to New York or LA and you get that five times a day. People love sneakers”.

So much so that, like him, they don’t even mind if, well, someone else’s sweaty feet have graced them beforehand. Sneakers, says Rashid, have been late to the party relative to the rest of fashion’s embrace of vintage clothing. But it’s a testament to the buying frenzy that what would have been so stigmatised as to be impossible just three years ago — buying pre-worn sneakers in a culture that celebrated the ‘boxfresh’ — is increasingly the norm.

“The simple reason is that it means being able to buy the coolest luxury products at a more attainable price. And of course it can also be driven by value too: you just don’t see the appeal of dropping $1000 on a pair of Travis Scott sneakers but might be willing to drop $500, even if someone has worn them a few times,” Rashid explains, as though that was an utterly typical thing to do as well.

“You know, it just makes a fantastic opportunity for people to buy sneakers in different ways,” he adds. “And for a huge business opportunity too.”

This article was featured in the InsideHook newsletter. Sign up now.