“The past two weeks have been probably my busiest two weeks in the six years I’ve been doing this.”

That’s an anecdote from Clark Simmons, a wine and spirits sales rep for Breakthru Beverage, a major distributor based in Denver. Simmons says that since shelter-in-place orders went into effect last month, he’s been “way busier” than the period between Christmas and New Year’s that traditionally serves as his industry’s peak season.

And nationwide statistics back him up. According to market research from Nielsen (as reported by Forbes), we’re seeing sales spikes in beer, wine and distilled spirits that are 42-75% higher than last year at the same time, with online sales up a whopping 243% since the pandemic’s start. Tequila, gin and pre-mixed cocktails are the biggest gainers.

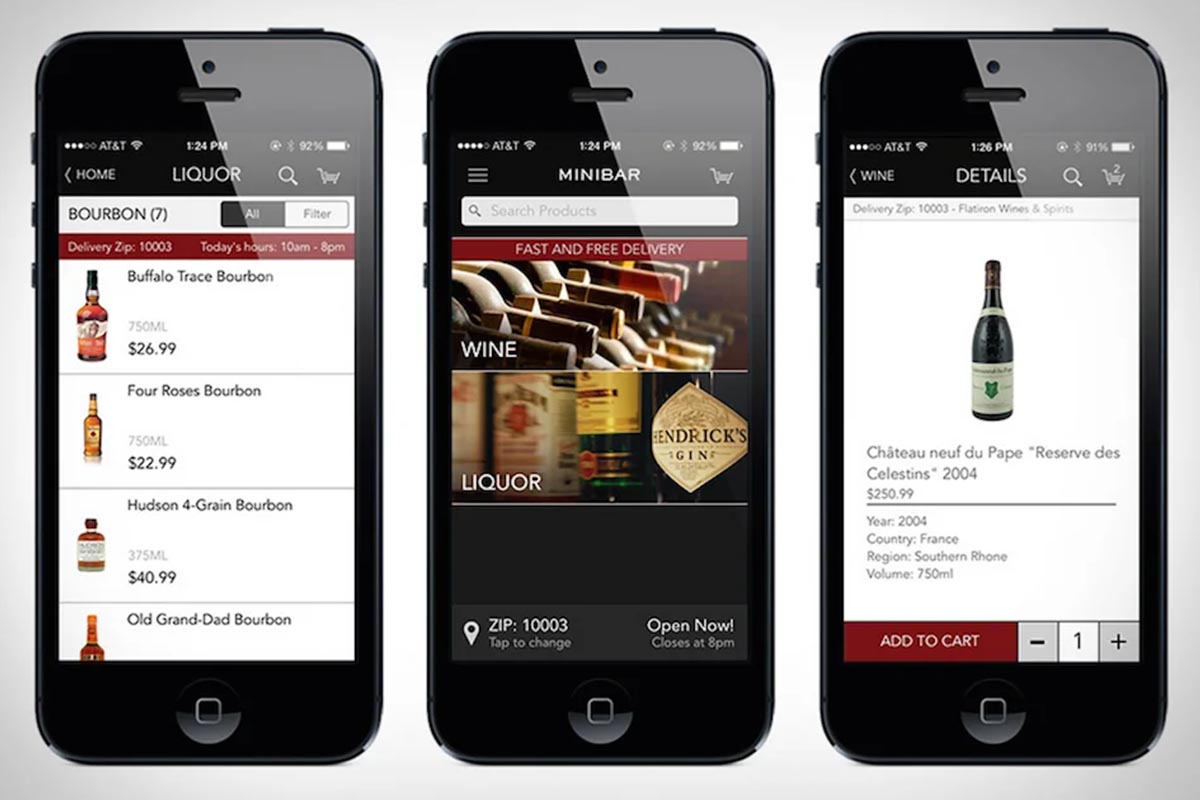

One of the biggest beneficiaries is Minibar Delivery. The service, which partners with local liquor stores in 18 states to offer door-to-door booze dispatches, has seen a 75% increase in orders and a 373% increase in new buyers. Overall, revenue is up a whopping 113%.

Other delivery services, such as Drizly, have also seen a three-figure percentage spike in sales.

As for what we’re ordering? Pretty much everything, though Minibar cites a few particular best sellers in wine (Oyster Bay, Veuve Clicquot, Kim Crawford, The Pinot Project), liquor (Tito’s, Bulleit, Casamigos) and beer/spiked seltzers (White Claw, Corona, Bud Light).

Our preferences also vary by region. “Oyster Bay Sauvignon Blanc is overall the most popular order in New York City, followed by 5-lb. bags of ice,” as Minibar Delivery’s CEO Lindsay Andrews tells InsideHook. “Washington D.C. has a likeness for the finer alcohol, the top purchase in the wine category being Veuve Clicquot and the top purchase in Scotch being the Macallan. Los Angeles has a taste for the eclectic, with its top whiskey being Yamazaki, and the top beer is Blue Moon.” (Overall, beer sales are up, but not as “exponentially” as wine and spirits, she says.)

While there have been obstacles — Andrews admits a typical order would take 30-60 minutes, but now could take over two hours in some cases — Minibar has hired additional customer service reps and the current focus is onboarding more retailers to the site.

But look at that list of best sellers. It highlights the other end of the booze spectrum, where craft breweries and distilleries without huge distribution networks are suffering at an alarming rate. A survey of 150 craft distillers released by the American Craft Spirits Association (ACSA) last week was grim: 87% of tasting rooms have closed as a direct result of COVID-19 — which is usually where smaller distillers derive 40% of their sales.

And without government stimulus, 67% of distilleries said they would be forced to close within three months — all this while 75% of these same craft distillers plan to or are already producing hand sanitizer to support the national shortage.

Craft breweries face similar challenges: with around 40% of craft brewers’ beers sold via draft, 26% distributed through a second party (restaurants, bars) and 14% at the brewery itself, smaller brewers who don’t have a grocery or liquor store presence are experiencing financial hardships, layoffs and closures.

“Brands that are on grocery store shelves tend to have fared better as grocery stores have been deemed essential business since the beginning of the outbreak,” as Margie A.S. Lehrman, CEO of the ACSA, tells InsideHook. “Unfortunately, many craft brands are unable to find a spot on the shelves there. Liquor stores that have remained open have reduced hours, too. And importantly, we also know that production is down throughout the craft industry so sales are coming from the prior inventory.”

Lehrman’s suggestion: Buy local and buy craft. Particularly, take advantage of the innovations in states which have responded to the pandemic and have started offering flexibility. In Virginia, for example, consumers can now have product ordered and transported directly from the distillery to the consumer; in other states (like New York) consumers can get go-to cocktails from take-out and delivery restaurants, while a few others have increased the ability to purchase bottles directly from distilleries.

Admittedly, there’s some thought that people are merely stockpiling booze in the short term. And with the World Health Organization recently suggesting that alcohol is a “poor coping mechanism,” consumers might start buying less … along with keeping their spending tight to deal with layoffs and an inevitable recession.

But booze reps like Simmons think the continued lockdowns should keep people imbibing. “People are drinking every night, they’re not commuting to work and they don’t have to look presentable,” he notes. “It’s already slowed a bit [from the first two weeks], but I think it’ll pick back up.”

This article was featured in the InsideHook newsletter. Sign up now.