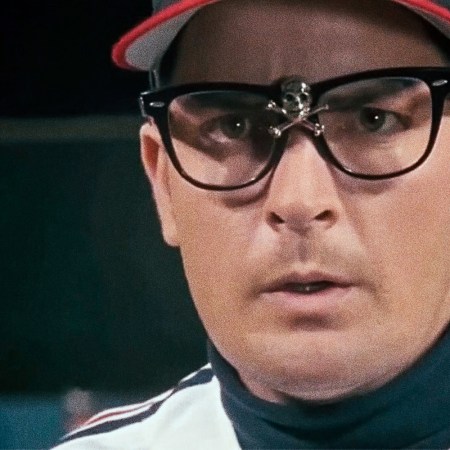

When hedge fund owner Steve Cohen reached an agreement to buy the New York Mets for a record price of $2.42 billion (the highest amount that’s ever been paid for a North American sports team) in September, long-suffering New York Mets fans had a reason for optimism.

In Cohen, the team had an owner with deep pockets who was seemingly free and clear of any of the financial issues that plagued the previous ownership group thanks to their losses in Bernie Madoff’s Ponzi scheme. Among other things, those issues have resulted in the team paying former New York infielder Bobby Bonilla more than a million dollars per year since 2011 — even though he hasn’t picked up a bat in MLB since 2001.

Looking to clear the stench of the previous ownership group from the air in Queens, Cohen came in with guns blazing, firing executives, signing off on trades and putting the team in play for top free agents, including ace pitcher Trevor Bauer.

Well, it was fun while it lasted … maybe.

Basically, thanks to a Reddit-led surge in the stock price of video game chain GameStop that came out of nowhere (which you can find an excellent explainer of here) and has raised shares from $18 to more than $300 since the start of the year, a hedge fund with a penchant for short selling called Melvin Capital Management has lost billions.

While the company does not belong to Cohen, Melvin Capital founder Gabe Plotkin used to work for Cohen and had $1 billion of his former employer’s money in his fund at the start of the month. Now, he has even more of Cohen’s cash after the Mets owner and another billionaire invested an additional $2.75 billion into Melvin to help Plotkin get through his horrible month, according to Sportico.

Cohen’s ties to Melvin’s losses due to GameStop had some baseball fans speculating about the team’s ability to have a top payroll moving forward and, given the franchise’s financial history, who could blame them?

But, seemingly aware of the concern, Cohen himself took to Twitter to assure fans Citi Field was not turning into the poorhouse. (Update: Cohen’s account has since been shut down.)

In reality, one really should not affect the other as Cohen is worth more than $14 billion and would still have well over $10 billion even if all his investments into Melvin Capital go to pot.

His company, Point72, as it happens, also owns a small 26,878-share stake in GameStop, according to The New York Post.

If GameStop’s price keeps rising, that should come in quite handy — especially when it is time to pay Bonilla’s annual bill on July 1.

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.