While you might only know the system from your travels, Clear could soon be a surprisingly big player in the post-COVID tech landscape.

The secure identity company, which has expanded its services beyond airports in recent years to stadiums, hotels and restaurants, is behind a new digital health passport initiative. Soon after the launch, Clear garnered a $100 million strategic funding round from (among others) Danny Meyer’s Enlightened Hospitality Investments, Liberty Media and the National Football League’s investment arm 32 Equity, according to the travel site Skift.

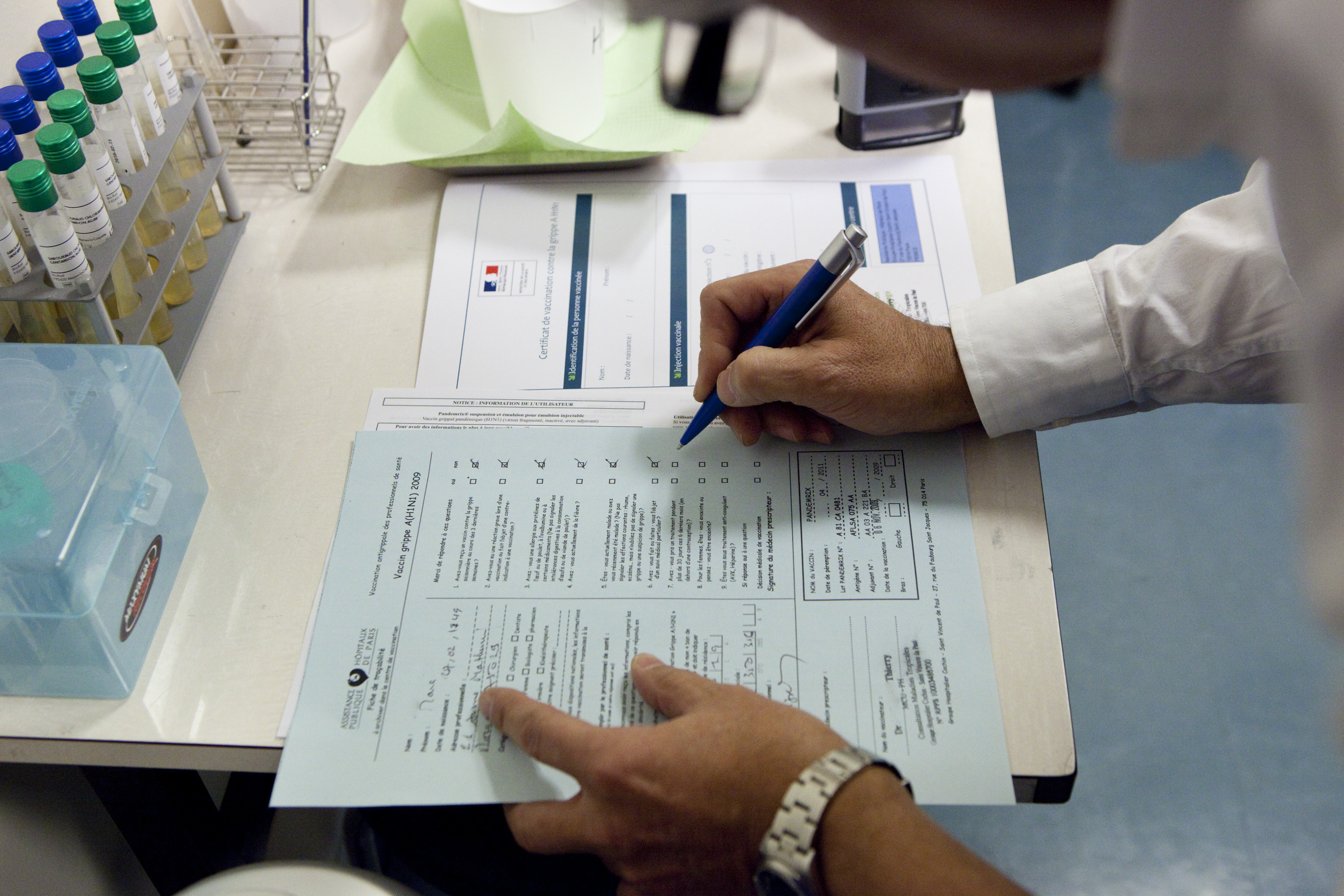

Clear’s new Health Pass offers vaccine validation, integrated lab results (with access to over 30,000 labs) and a phone-based app that could, potentially, allow for reduced travel restrictions but also be utilized at a local level with venues, offices and events. The pass is already being used by various sports organizations, including the National Hockey League.

“I’ve seen firsthand how powerful CLEAR’s technology can be with Health Pass creating safer working environments for our team members at Union Square Hospitality Group,” Meyer said in a statement. “And for many years I’ve experienced the exceptional hospitality CLEAR extends at every touch point. We are proud to call CLEAR a partner and thrilled to be a part of their future with our investment.”

If governments and businesses can agree on various tech standards for these health passports, Clear has a, well, clear advantage in the field, since they already offer a secure identification system that’s used around the world.

Below, some other tech companies that have seen huge gains during the pandemic, or likely will in the next several months as conditions shift (and hopefully improve) … that aren’t named Google or Amazon:

Peloton: Exercising at home is big business. If supply chain issues don’t hamper the company, they’ll clear $4 billion in sales this year.

Zoom: It can take as little as 18 or up to 254 days to form a new habit. Even at that most extreme limit, everyone’s pretty much bought into using Zoom, and the service has certainly made a good chunk of in-person meetings seem redundant. Integration into “hybrid” meetings, virtual receptionists and, uh, social media inspired “effects” are on the horizon. Plus, the company now has cash to burn for acquisitions.

Square: “Analyst-defying growth” is how some experts described this mobile payment service, which saw its Cash App digital payment system more than make up for the loss of use in restaurants and small businesses in 2020. When dining and shopping return, expect Square to get business customers back while maintaining its newfound digital payment audience.

Drizly: Recently purchased by Uber for $1.1 billion, the alcohol delivery app now has access to more drivers, an advanced tech infrastructure and an audience that has become accustomed to ordering from home (whether the service is eventually absorbed into Uber / Uber Eats or something that remains to be seen).

Better.com: LinkedIn’s no. 1 startup of 2020, this digital mortgage lender has seen tremendous growth as homeowners look to refinance or move.

For more travel news, tips and inspo, sign up for InsideHook's weekly travel newsletter, The Journey.