You might think that an investment firm headed by a veteran of the finance industry and managing $10 billion in assets would be a solid bet to thrive indefinitely. In the case of Archegos Capital Management, however, that assumption proved incorrect. And, according to a New York Times report by Kate Kelly, Matthew Goldstein, Matt Phillips and Andrew Ross Sorkin, the result was “one of the biggest implosions of an investment firm since the 2008 financial crisis.”

The way that Archegos imploded was something of a perfect storm — and demonstrates that in the financial industry, even the safest bets might not be as stable as they seem.

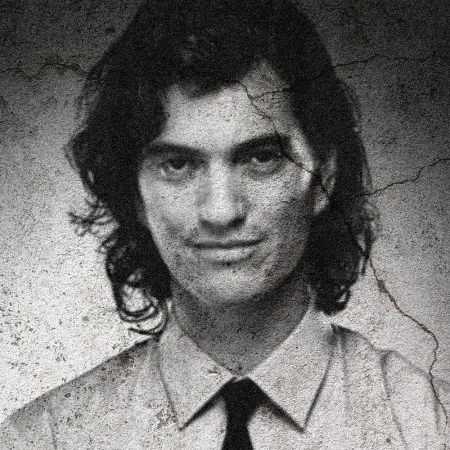

Bill Hwang, the founder of Archegos, was known for his long career on Wall Street and a propensity for donating to Christian organizations. But with the firm’s collapse has come collateral damage — Archegos held a substantial number of shares in ViacomCBS, and with the firm’s collapse has come a substantial drop in the media company’s stock price.

As for why Archegos had those difficulties, the answer can be found in a host of events that took place in close proximity, including a fundraising effort from ViacomCBS and sharp drops in the prices of other companies Archegos had invested in. By the end of one week, Archegos’s assets were being sold off by its lenders.

The whole article is an unsettling illustration of how interwoven certain companies’ fortunes are — and how a series of unrelated events can have substantial consequences on a massive level.

Subscribe here for our free daily newsletter.

Thanks for reading InsideHook. Sign up for our daily newsletter and be in the know.